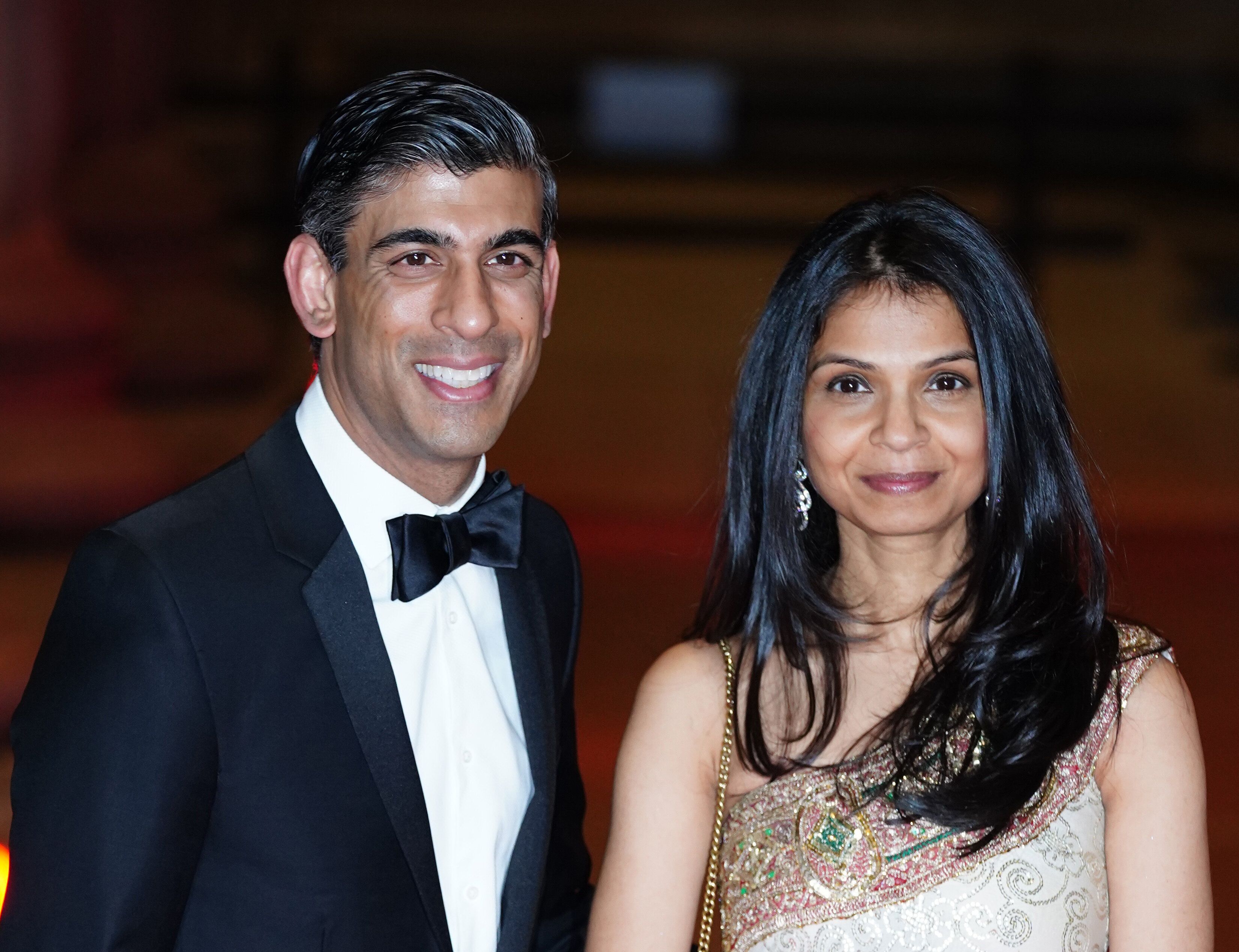

Chancellor Rishi Sunak is under fire after it was revealed his wife has “non-dom” status.

It means Akshata Murthy, daughter of an Indian billionaire, can earn money from abroad free of UK tax.

Advertisement

A non-domiciled tax status is designed for individuals whose permanent home is not the UK.

Murthy, who lives in Downing Street with her husband, said she has the status because of her Indian citizenship as the country does not allow its citizens to hold dual nationality.

Advertisement

However, some experts argue there are ways she can remain an Indian citizen while ending her non-dom status.

There is no suggestion any laws or rules have been broken, however Labour leader Sir Keir Starmer has described the arrangement as appearing to represent “breathtaking hypocrisy”.

Advertisement

A Treasury spokesman has insisted that Sunak has “followed the ministerial code to the letter in his declaration of interests”.

The code states that, on appointment to each new office, ministers must provide their permanent secretary with a full list of all interests which might be thought to give rise to a conflict – including the interests of their spouse, partner or close family.

Labour is arguing that her non-domicile status is a matter of public interest because the chancellor may have directly benefitted from it.

They have written to Sunak with 12 questions, they include:

Advertisement

1. How much have you benefited from Murthy’s tax status as a ‘non-dom’?

2. Has Murthy ever claimed the remittance basis?

3. Do you accept that claiming the remittance basis was an active choice by Murthy, and not [as her spokesperson claimed yesterday] something that followed automatically from her citizenship?

4. What is Murthy’s claimed domicile?

5. On what basis is it not the UK, given her life suggests she intends to permanently remain in the UK?

6. For how long has Murthy been claiming the remittance basis? Companies House filings say Murthy has been living in the UK since at least 2013.

7. How much tax has been saved by claiming the remittance basis?

8. Where are all of Murthy’s non-UK income and gains fully taxed?

9. Does Murthy hold investments/property through trusts or companies in offshore jurisdictions?

10. When Murthy hits 15 years of being in the UK, she will cease to be entitled to claim the remittance basis. Often the wealthy avoid the resultant tax by putting their assets into trusts before the expiry of the 15 years. Will she commit not to do that?

Advertisement

11. Do you as chancellor support the claim of Murthy’s spokesperson that her Indian citizenship means she must be treated as non-domiciled for UK tax purposes?

12. What measures have you as chancellor put in place to ensure that you are not involved in Treasury discussions around potential amendments to the non-domicile status rules?

A Treasury spokesperson has not responded to a HuffPost UK request for a response to the questions.