The UK just managed to avoid falling into recession towards the end of last year.

After shrinking for one quarter, it (ever so slightly) jumped back between October and December by just…not growing at all.

Chancellor Jeremy Hunt said this was a sign “our economy is more resilient than many feared” – but warned that we’re still not “out of the woods yet”.

Advertisement

It’s also worth noting that Friday’s data – which has helped experts decide if we’re in recession – is only the first estimate. These numbers are often revised later.

But what does all this mean?

What has just happened to our economy?

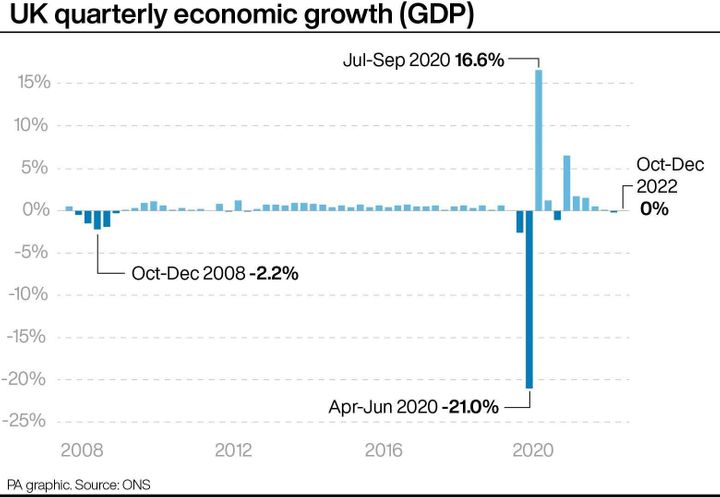

Data from the Office for National Statistics (ONS) said the economy recorded zero growth between October and December.

According to the ONS’s director of economic statistics Darren Morgan, it comes down to a few different factors – including strikes.

“Public services were hit by fewer operations and GP visits, partly due to the impact of strikes, as well as notably lower school attendance,” he said.

Advertisement

“The break in Premier League football for the World Cup and postal strikes also caused a slowdown.

“However, these falls were partially offset by a strong month for lawyers, growth in car sales and the cold snap increasing energy generation.”

Across the whole of 2022, the economy did grow by 4%, despite the cost of living crisis squeezing household incomes.

PA Graphics via PA Graphics/Press Association Images

What is a recession?

A recession is defined as two consecutive quarters (so six months in total) where the economy shrinks. This is also known as a decrease in the value of goods and services we produce, Gross Domestic Product, or GDP.

If GDP declines in value people’s income tend to fall.

In the third quarter of 2022, July to September, the economy did shrink by 0.2%. But because it didn’t shrink again the next quarter, we’ve just missed out on meeting the criteria for a recession.

Advertisement

The last recession was in 2020 at the height on the pandemic, but it only lasted for six months, although it did see a 20.4% reduction in the UK economy between April and June in 2020 though – the largest on record.

Before that, the 2008 global financial crash went on for five quarters.

Why is 2023 still expected to feel like we’re in recession?

Even if we don’t meet the technical definition for being in a recession right now, experts believe that it will very much feel like the country is in a period of negative growth already.

After all, the UK is still the only G7 country which now has a smaller economy than it did prior to the pandemic.

And experts at the International Monetary Fund (IMF) still expect the UK to be the only G7 country to fall into recession this year, and set to perform even worse than Russia.

And 2023 is still set to feel like a recession for many, according to an economist at National Institute of Economic and Social Research (NEISR).

Advertisement

“A focus on the economic crisis faced by most of the British population, rather than technicalities, offers a more insightful perspective,” NEISR’s Paula Bejarano Carbo told POLITICO.

One in four UK households (potentially seven million families) will not be able to fully pay off their food and energy bills in 2023 – that’s an increase from one in five last year, according to NEISR.

So how would a recession affect you?

The job market

Recessions usually trigger companies to let more people go, as consumers spend less and businesses have to adjust their margins.

This pushes unemployment levels up.

Employers may also reduce workers’ hours, cut wages, pull back on bonuses and financial incentives or introduce a hiring freeze to an effort to reduce their outgoings.

The stock market will probably struggle too. As people tend to send less, companies report lower earnings, investors consider liquidating their stocks.

Advertisement

Consumer buying habits

Everything becomes more expensive in a recession – and inflation is already at a 40-year-high of 10.5%.

The Bank of England has been increasing interest rates in recent months in an effort to decrease the double-digit inflation. That means the price of borrowing increases.

So your credit card balance will also come with higher payments, and anyone looking to secure a mortgage will likely only be offered more expensive deals.

Only if you have a fixed rate mortgage will your monthly payback stay the same.

So lenders may want to think twice before letting people take out loans, which could affect people’s ability to go after large purchases.

Government spending

More economic growth means the government usually gets more money in taxes.

It can then spend more on benefits, public services, government workers wages or reduce taxes – but this can equally all be negatively affected if the economy shrinks too.

Advertisement

How can you prepare for a possible recession?

The Office for Budget Responsibility (OBR) still expects the economy to shrink by 1.4% in 2023, with the recession causing an overall drop of 2% in GDP.

Although it is expected to grow again by 2025, it’s still best to prepare now.

- Pay off your debt sooner rather than later – interest rates are expected to continue rising this yer

- Save, if you can, in the event of sudden redundancy

- Try to secure multiple sources of income

- Look for a recession-proof career, if possible.